Introduction

Selling your home can be a major financial and emotional decision, and the process can often feel quite overwhelming. From a legal perspective, there are several critical steps that must be taken to ensure a smooth and compliant sale.

Selling residential property in NSW is governed by the Conveyancing Act 1919 (NSW) and other related legislation. Engaging a solicitor early in the sale process is essential to help you avoid common pitfalls, ensure legal compliance and protect your rights throughout the transaction.

This article provides a step by step guide to selling your residential property in NSW.

View our article on buying residential property.

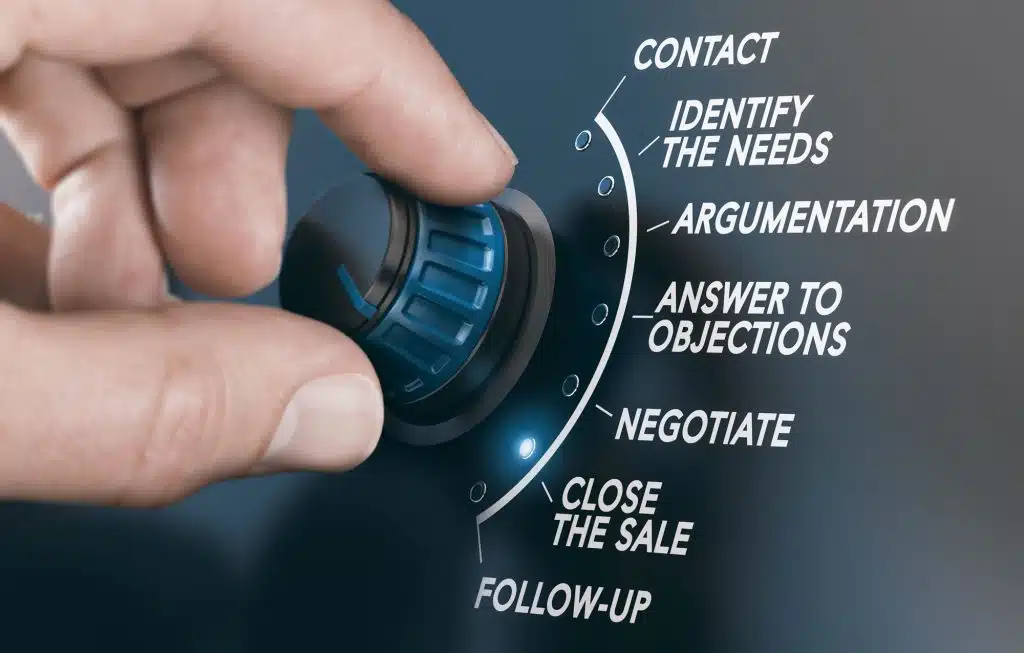

Steps for Selling a Residential Property

The process of selling a residential property can be broken down into the following key steps:

Issue Contract of Sale

In NSW, you are required to prepare a contract of sale for prospective purchasers before a property is listed for sale. This legal requirement is in place to ensure that prospective purchasers have access to relevant information about the property.

This contract must be prepared by a solicitor or conveyancer and contain the necessary disclosure documents prescribed by law.

Prescribed documents include:

- Title search;

- Section 10.7 certificate from council. This is a planning/zoning certificate;

- Drainage and sewer diagrams;

- Documents relating to any easements or covenants over the land; and

- Strata documents (if applicable).

Market the property

Once the contract is prepared, you or your real estate agent can begin marketing the property for sale.

It can be beneficial to put your real estate agent and solicitor in contact so they can discuss the sale of your property as needed throughout the sale.

Respond to buyer enquiries

Your real estate agent will handle most interactions with prospective buyers. However, your solicitor may assist in:

- Answering legal questions asked by the prospective purchaser representative; and

- Negotiating any proposed amendments to the contract.

You should not accept or sign any offers made by prospective purchasers until your solicitor has reviewed the contract terms and provided you with legal advice.

An offer is not formally accepted or legally binding in NSW until contracts have been exchanged.

Exchange

Once both parties are ready to proceed, contracts are exchanged. This occurs when each party signs an identical copy of the contract, and the contracts are dated. This may be done either electronically or in hard copy format.

Depending on the offer made by the purchaser, the contract may be subject to a cooling off period. The standard cooling off period in NSW is five-business days.

At the commencement of this period, the purchaser will pay a 0.25% deposit, and they may choose to rescind their offer during the cooling off period. If the purchaser rescinds the contract during this period, they will forfeit the 0.25% deposit to you.

In accepting an offer from a prospective purchaser, you may request that the purchaser waive their right to a cooling off period by way of a section 66W certificate. Additionally, cooling off periods are not applicable where a property is sold at auction.

Once contracts are exchanged and the cooling off period lapses (if any), the contract becomes legally binding on both parties and the full deposit amount is payable.

Pre-settlement

The standard settlement period in NSW is 42 days, although this can be negotiated between the parties.

During the time between exchange and settlement:

- The buyer may conduct final due diligence (e.g. Inspections, finance approval);

- Your solicitor will liaise with the buyer’s representative to satisfy any pre-settlement conditions;

- Your mortgagee (if any) will prepare discharge documents; and

- You will need to arrange to vacate the property before the agreed settlement date.

Prior to settlement, your solicitor will advise you of the amount of funds to be received on settlement taking into consideration any adjustments that may need to be made for (amongst other things) council or water rates and any funds that need to be paid to satisfy any mortgage over the property.

Settlement

On the day of settlement, legal ownership will be transferred to the purchaser.

In NSW, this process will occur electronically via PEXA (the Property Exchange Australia platform). Your solicitor will act on your behalf in PEXA.

In completing the transaction, your solicitor will confirm receipt of the balance of the purchase price, ensure the mortgage is discharged (if applicable) and provide the agent with authority to release any deposit held by them to you.

Once settlement is complete, the purchaser becomes the legal owner of the property, the agent may hand over the keys and your obligations under the contract of sale end.

Post-settlement

Following settlement, your solicitor will:

- Notify you that settlement has occurred; and

- Provide a settlement report to you including a breakdown of disbursements and adjustments.

Conclusion

There are several steps involved in selling property in NSW, and there are several legal steps that must be followed to ensure compliance and avoid costly delays. By engaging a solicitor early in the process, you can avoid delays to settlement, ensure the correct disclosures are made, ensure your compliance with all legal requirements, protect your interests and ensure that the transaction occurs smoothly.

Every property sale is unique and there is no one-size-fits-all approach. As such you should always obtain tailored legal advice for your circumstances.

This information provides a general overview only and we recommend obtaining professional advice relevant to your circumstances.

Get in touch

If you or someone you know wants more information or needs help or advice in relation to selling a property, please contact us.

Related Resources

Business Sale and Purchase

A Step-by-Step Guide to Selling Your Business

This article breaks down the essential steps to help you navigate the sale process with confidence to secure the best outcome.

Read moreCorporations Contracts

Share Sale Agreements: A Comprehensive Guide

In a share sale, the ownership of a company is transferred by selling the shares held by the existing shareholders.

Read more